Despite lagging the FTSE 100 slightly in the last 12 months, London Stock Exchange (LSE: LSEG) shares have been a clear winner for investors over the longer term.

If I’d put £1,000 to work in August 2018, for example, my holding would now be worth around 80% more.

But that return might be just the start of things if the firm’s involvement in AI takes hold.

So, is there an argument for buying the stock now over semiconductor giant Nvidia (NASDAQ: NVDA)?

Contrarian call

To some extent, such a question might seem nonsensical after Wednesday’s (23 August) update from the US-listed titan.

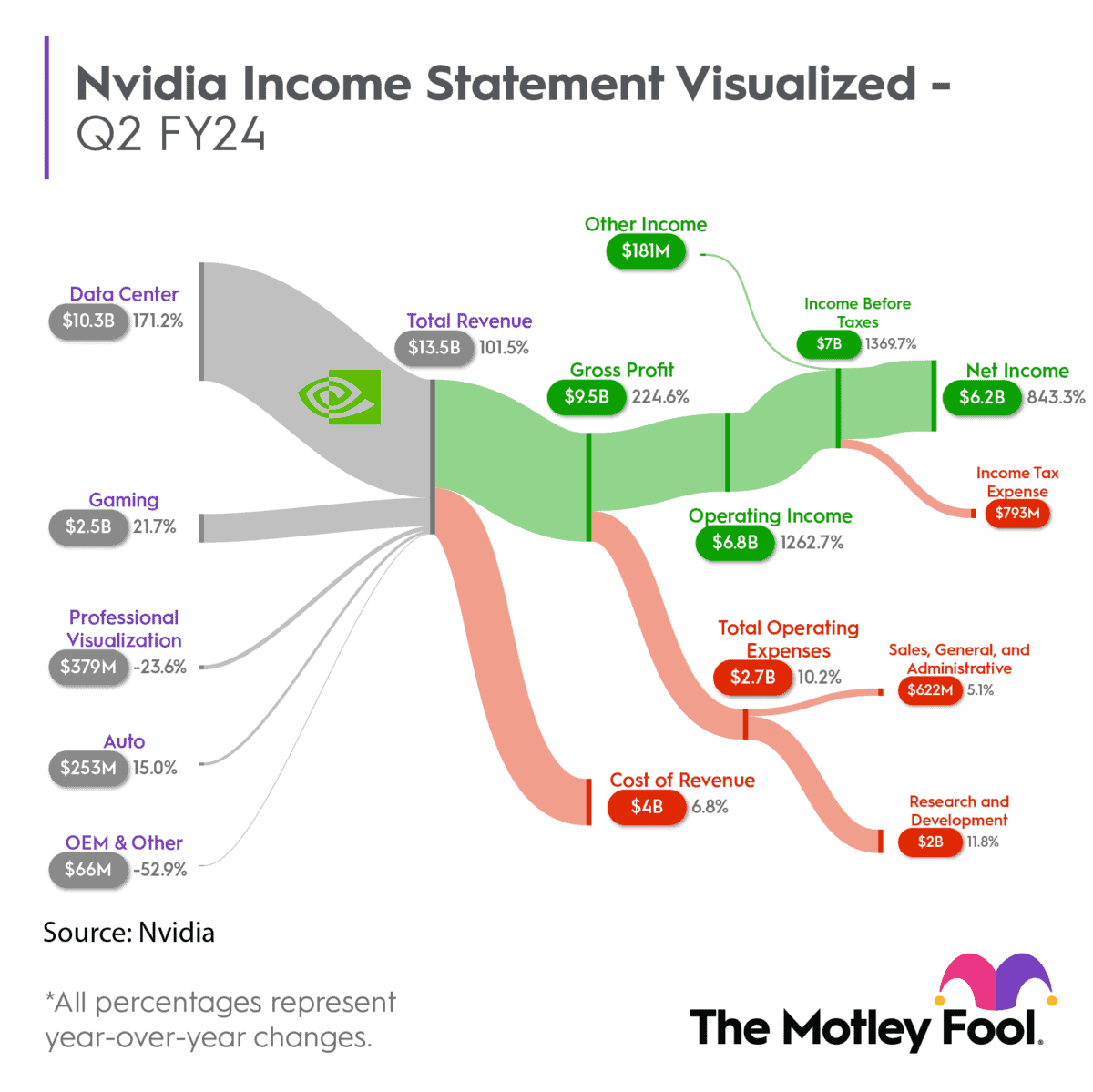

Nvidia posted revenue of $13.5bn in the quarter ending July 30, far above the $11.2bn that was anticipated. This number is set to rise to roughly $16bn in Q3. This underlines just how vital its graphics processing units (GPUs) are becoming to the burgeoning AI sector.

Not unreasonably, this has sent investors into a frenzy.

Having already delivered outstanding returns over the last year (+174% as I type), Nvidia shares look set for another leap.

Primed to fall?

The trouble with all this is that, regardless of the outlook for AI, the valuation looks excessive relative to the vast majority of stocks.

I certainly don’t need any special insight to recognise that the share price movement since last September has been extreme.

Unfortunately, nothing rises in a straight line. As proof of this, Nvidia stock fell roughly two-thirds in value between November 2021 and October 2022.

Knowing this, there’s at least a chance that history could repeat itself if it even slightly fails to live up to Wall Street’s rapidly-adjusting expectations.

Safer bet?

Of course, predicting the near-term behaviour of share prices is difficult, if not impossible.

Still, London Stock Exchange shares change hands on a price-to-earnings (P/E) ratio of 25. That in itself isn’t cheap for the UK market. Nevertheless, it’s far lower than what it would cost to buy Nvidia stock today.

The recent unveiling of a partnership with Microsoft goes some way to justifying it, especially as the tech titan also snapped up a 4% stake in the FTSE 100 company.

LSE is now collaborating to build bespoke generative AI models for use in financial services. If things work out, I reckon there’s every chance investors will be rewarded over time.

Notwithstanding this, one needs to bear in mind that LSE tends to suffer when markets fall because there are likely to be far fewer IPOs. The growing desire of UK companies to list in the US is another emerging issue.

I’d buy both…eventually

Whether London Stock Exchange shares can outperform Nvidia stock over the next few years simply because the latter’s valuation looks (very) frothy is open to debate.

That said, I’m bullish on the long-term outlooks of both companies.

For this reason, I’d consider investing in each eventually if it weren’t for the fact that I already have exposure via several funds, including Lindsell Train Global Equity (London Stock Exchange) and Blue Whale Growth (Nvidia).

For now, this arrangement matches my risk tolerance. I’m just not confident that buying Nvidia stock today, in particular, won’t come back to bite me in the short term.

The time to really pile in will be when sentiment (hopefully temporarily) turns.